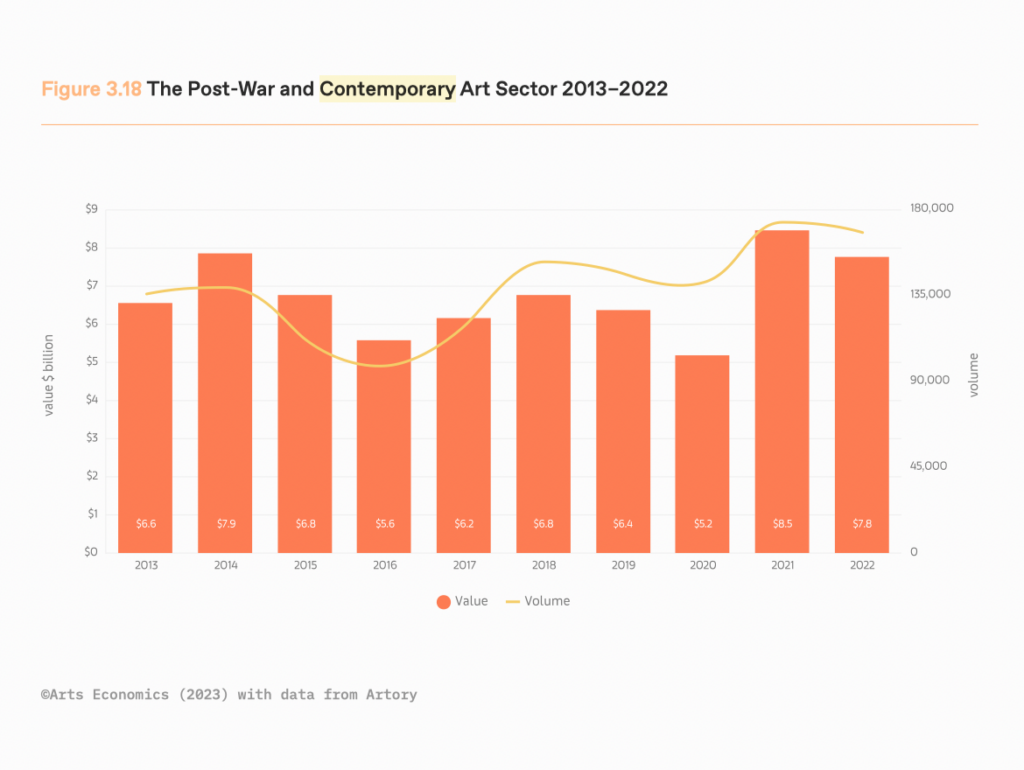

The art market of today consists of a global network of dealers, galleries, international biennales and art fairs. This global market has surged to unprecedented heights in the past twenty years with Post-War, Contemporary and Modern art as the dominant genres creating art market records.

However, since 2019 the art market experienced a correction where sales softened significantly. The slowdown continued well into 2020 due to lockdown-induced uncertainty and record-breaking losses caused by the Covid-19 pandemic but despite 2020 ending on a relatively slow note, the art market recovered quickly and at incredible speed in the months that followed, in large part due to a new generation of buyers entering the art market in a relatively short period of time.

In 2020, the number of ultra high net worth individuals (eg. billionaires) around the world rose 7% due to the booming tech and crypto areas, according to Clare McAndrew, art economist. She remarked, “From the buying side, there were a lot of people with a lot of time and cash, and there weren’t that many outlets for their spending.” As such, the global art market reached new heights with a record-breaking year in 2021. Global auction sales at Christie’s, Sotheby’s and Phillips ended at $12.6 billion in 2021, up 70.2% from 2020.

ArtTactic’s comparative analysis, which tracked all auction sales in 2021–physical, online-only and hybrid sales– at the top three houses (Sotheby’s, Christie’s and Phillips) shows similar results. The Market analytics company’s report revealed that the Contemporary art segment in particular, unsurprisingly, was the key driver of the market growth accounting for a whopping combined market share of 53.8%, or record breaking sales total of $3.53 billion. For purposes of this analysis, I define Post-war and Contemporary as work by artists born between 1911 and 1974. This sector includes works by “ultra contemporary” artists under forty-five such as Shara Hughes, Matthew Wong, and Tauba Auerbach, as well as digital artists such as Beeple (Mike Winkelmann, 40), whose NFT artwork, Everydays: The First 5000 Days, a Jpeg of 500 images, sold for over US$69 million at Christie’s in the Spring. It was the most shocking sale to occur since Banky’s self-shredding painting, Love is in the Bin, at Sotheby’s in 2018 that incidentally, was resold at Sothebys in 2021 for a whopping $25.4m. With incredibly robust aggregate sales results in 2021 the global art market proved resilient for top billing artists harkening a new era of art buying shaped by the pandemic.

It is important to note that with regard to the lower to mid-tier Contemporary art market sector (ie. the emerging to mid-career level artists) the market proved to be much slower and even lackluster. While some secondary market sales were achieved, results for mid-level artists and below did not reach the same heights achieved by the more established contemporary artists or even the trending “ultra-contemporary” rising art stars.

In the first quarter of this year (2022), we witnessed a spate of high-value auctions at Sotheby’s, Christie’s, and Phillips netting more than $2.5 billion. This proved to be a good signifier of a strong overall art market at the start of the new year. In May alone, Christie’s auctioned a 1964 Andy Warhol portrait of Marilyn Monroe for $195 million—the highest auction price for a 20th-century work.

Additionally, 30 works of art from the Harry and Linda Macklowe Collection, including blue-chip Contemporary artists Jeff Koons, Gerhard Richter and Agnes Martin sold for a combined $246.1 million. Highlights included another untitled painting by Rothko, which sold for $48 million and a self-portrait by Warhol that fetched $18.7 million. By the end of the night, it was a “white glove sale,” meaning every work had been sold (source: NY Times).

A thriving first quarter in 2022 was a sharp contrast to the more sluggish market from early on in the pandemic. According to the Art Basel and UBS annual Global Art Market Report, global art sales had recovered strongly from the onset of Covid, with sales reaching $65.1 billion in 2021—a 29 percent increase from the previous year. (source: Art Basel).

The state of the auction market for the first five months of 2022 year revealed the following takeaways:

- Grand total generated at auction between January and May 20, 2022 = $5.7 billion (barely exceeding the sector’s previous high-water mark in 2018). (The two sums are separated by a mere $83 million.)

- Sell-through rate (the ratio of lots offered to lots sold)= 73.4% (higher than in any other year examined except 2021. In the wake of the pandemic, auction houses have grown especially conservative about offering works they are sure will find buyers).

- Average price of a work of art sold at auction during this period = $48,670 (up a staggering 180 percent from 2020 and 26 percent from 2021) Perhaps a reflection of pent-up supply of high-priced works that collectors held onto during lockdown.

- In 2020 total US art sales plummeted to under $500 million but two years later in 2022, total US sales reached a record $3.4 billion, a jump of more than 700 percent. (source: Morgan Stanley/ Artnet survey)

[Sources: New York Times, UBS The Market Report 2022, Art Basel Market Report, Christie’s and Sotheby’s Auction houses, ArtsEconomics.com, artnet.com, Barrons, New York Times, Forbes]

If you have any inquiries please email info@hlkartgroup.com