The following art market analysis of the Post-War and Contemporary art market during 2019 was researched and written by Heidi Lee Komaromi

2019: SUBDUED SALES AND NEGATIVE GROWTH

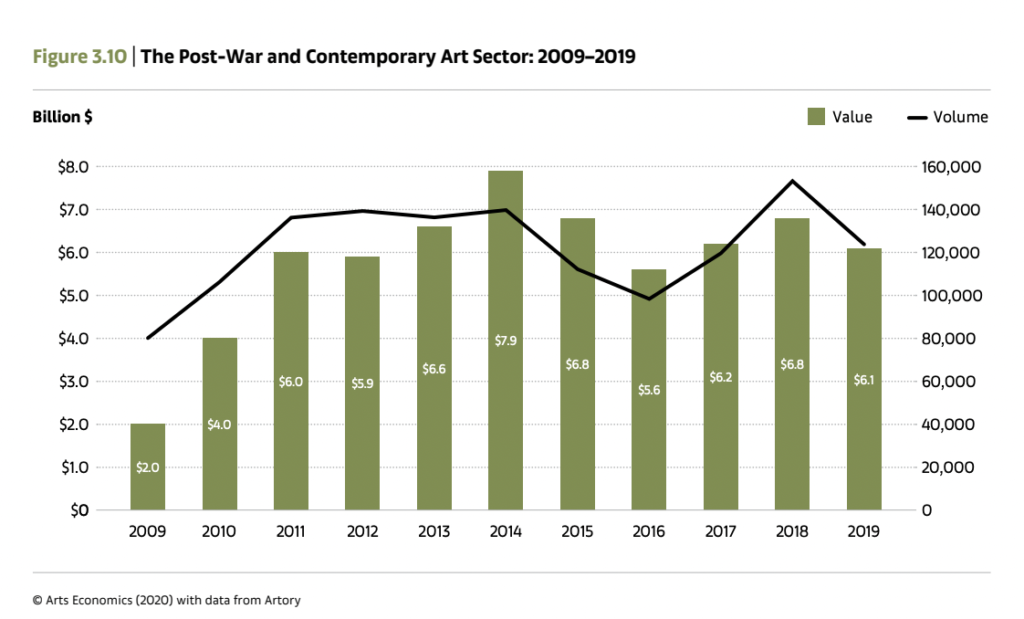

The Post-War and Contemporary sector consists of a variety of artists, including both deceased artists and living artists at various stages of their careers. Contemporary art has been one of the fastest growing yet most volatile segments over the past ten years, with trends influenced by sales of very highly priced works. The year 2019 however, was considered a more challenging year for the Contemporary art market after witnessing two years of consecutive growth. A significant reduction in volume of art of very highly priced works was the main cause of subdued growth and lower sales overall.

According to UBS’s annual art market report in conjunction with Art Basel, Post-War and Contemporary art was the largest sector of the fine art auction market in 2019, with a share of 53% by value. The UBS report looked at the different market segments such as gallery businesses, auction houses, changing patterns of global wealth and art collecting, art fairs, online sales, and the economic impact of the art market in general.

Combined primary and secondary market sales had reached $6.1 billion, a decline of 10% year-on-year compared to global sales of the art and antiques market which had reached an estimated $64.1 billion in 2019, down 5% year-on-year, returning the market to just above its 2017 level.

ArtTactic, an art market research company, reported global auction sales for Post-War and Contemporary art down 19.8% in 2019 from 2018. The 20.3% weaker sales numbers in the first half of 2019, continued into the second half of the year, with a particularly weak 4th quarter. The report analyzed auction results from all public auctions (not including online only sales), at Christie’s, Sotheby’s and Phillips. The three auction houses experienced an overall decline in public auction sales. Interestingly, Phillips fared best though still negatively out of the three houses, with a 9.1% year-on-year decline in sales whilst Sotheby’s experienced a year-on-year fall of 18.4% in sales and Christie’s sales were down 22.2%.

Total evening and day sales at the three auction houses in New York and London saw a decline of 12.7% in 2019. However, evening and day sales were showing optimistic trends. While the evening sales total was down 15.1% in 2019, day sales saw an 11.6% increase in sales that year. This could signal that the market is looking for new opportunities in lower price segments of the market such as younger emerging or under-recognized established artists including Loie Hollowell, Jonas Wood, Tauba Auerbach, Jammie Holmes, Frank Bowling, Nicole Eisenman and Derek Fordjour among many others.

No doubt the market decline was a reflection of the global financial crisis and effects of the Great Recession but there are a couple silver linings. The continued investments made by art businesses and investors in both regional and foreign markets specifically China, Hong Kong and Korea will help fuel the market foward as will the online art market that stormed ahead in 2019. Hiscox reports that the market is likely to reach 25% of the overall market by the end of 2021.

Sources: UBS The Art Market 2020, ArtTactic, Christie’s and Sotheby’s auction houses.

If you have any questions about the art market feel free to email info@hlkartgroup.com