The following 2021 art market analysis of the global art market was researched and written by Heidi Lee Komaromi

2021: A REMARKABLE COMEBACK

As reported by ArtTactic’s recent analytics research and reflected in Christie’s and Sotheby’s end of year sales results, the global art sector in 2021 experienced a remarkable comeback where aggregate auction sales worldwide reached a new all-time high just following a lackluster pandemic year.

Collective auction sales for the major sectors–Old Masters, Impressionist, Modern, Post-War and Contemporary art– ended the year 74% higher than 2020, or $65.1 billion, just surpassed its previous peak in 2018. In particular, the Impressionist art sector totaled $963 million, up from $278 million last year. The Impressionist and Post-Impressionist art sector, per The Art Market report, is defined as deceased artists at advanced stages of their careers who are born between 1821 and 1874. Modern is defined as artists born between 1875 and 1910.

Notably, the Modern category too, rebounded with auction sales totaling $1.28 billion in large part due to two Sotheby’s marquee sales –The Macklowe Collection and the MGM Resorts Collection accounting for 17.4% of total auction sales of Modern art that year.

2020 figures were still better 2019 though to put things in further perspective. The Impressionist and Post-Impressionist sector in 2019 for example, experienced the most substantial annual decline in the last 15 years at 51%, or a mere $870 million according to UBS’s The Art Market Report. This was the single largest decline of all fine art sectors. Values reached 11% (below the recession of 2009!) and 33% less lots sold. Because 19th/20th century art sectors are highly supply-driven markets, the limited supply of high-end works available for sale, both publicly or privately, resulted in one of the largest contractions in sales of all sectors.

Despite 2020 ending on a relatively sour note, marked by the increased lockdown-induced uncertainty and record-breaking losses, the art market adapted surprisingly well and at an incredible speed in 2021. Perhaps the two years of unprecedented market disruption and duress led industry leaders and influencers alike to form a consensus of outside-the-box thinking and risk taking, namely digital innovation and experimentation as seen with the NFT mania.

Furthermore, 2021 also saw a new generation of buyers enter the art market at an alarming rate. The number of billionaires (many from Asia) rose 7% in 2020 due to the booming tech and crypto areas, with the wealth they held growing 32% over the year, according to Clare McAndrew, art economist. She remarked, “From the buying side, there were a lot of people with a lot of time and cash, and there weren’t that many outlets for their spending.” As such, the global art market reached new heights with a record-breaking year. Global auction sales at Christie’s, Sotheby’s and Phillips ended at $12.6 billion in 2021, up 70.2% from 2020.

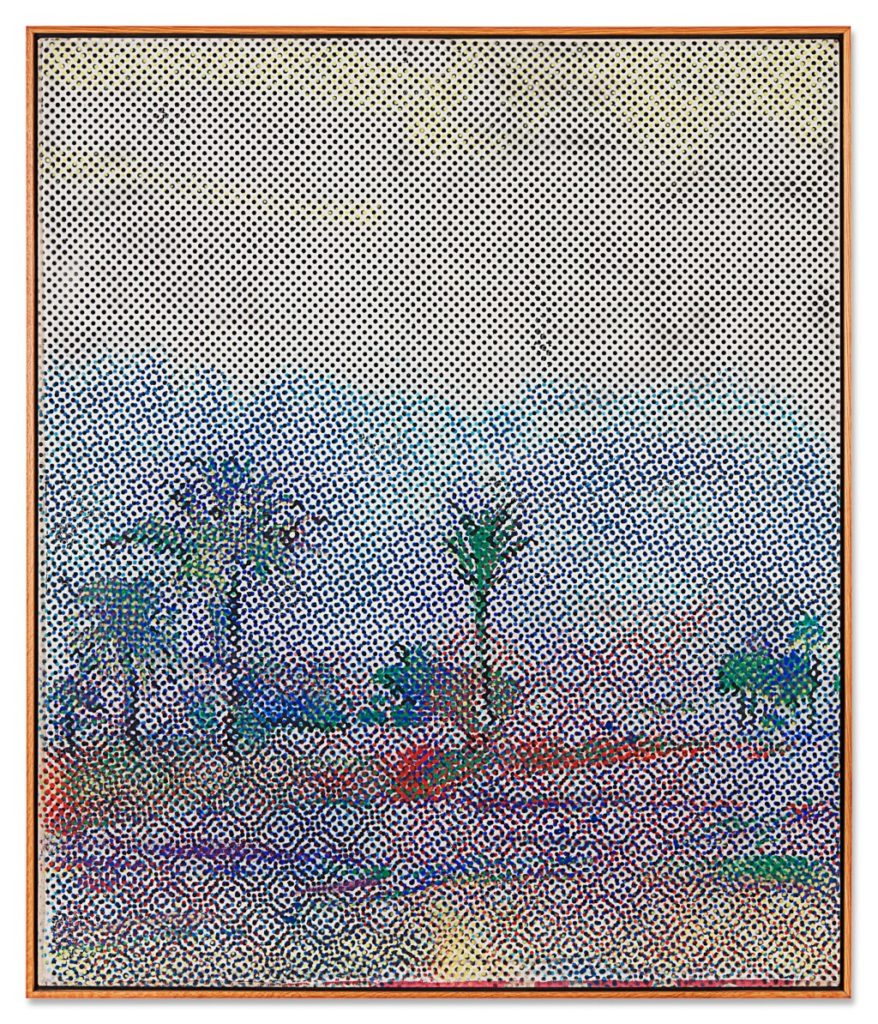

Arttactic’s comparative analysis, which tracked all auction sales in 2021–physical, online-only and hybrid sales– at the top three houses (Sotheby’s, Christie’s and Phillips) showed similar results. Their report revealed that the Contemporary art segment, unsurprisingly, was the key driver of the market growth accounting for a whopping combined market share of 53.8%, or record breaking sales total of $3.53 billion. This sector includes works by artists under forty-five years old such as Shara Hughes, Matthew Wong, and Tauba Auerbach, as well as digital artists such as Beeple (Mike Winkelmann, 40), whose NFT artwork, Everydays: The First 5000 Days, a Jpeg of 500 images, sold for over US$69 million at Christie’s in the Spring. It was the most shocking stunt to occur since Banky’s self-shredding painting, Love is in the Bin, at Sotheby’s in 2018. Which, incidentally was resold at Sothebys in 2021 for a whopping $25.4m, setting a new auction record for the anonymous artist.

With incredibly robust aggregate sales results in 2021 it seems the global art market adapted quickly and is now well poised for a new era of art buying ineluctably shaped by the pandemic.

Sources: New York Times, UBS The Market Report 2022, Art Basel Market Report, Christie’s and Sotheby’s Auction houses, ArtsEconomics.com, artnet.com, Barrons, New York Times

If you have any questions about the art market feel free to email info@hlkartgroup.com

See also Market Analysis: Post-War and Contemporary Art 2019